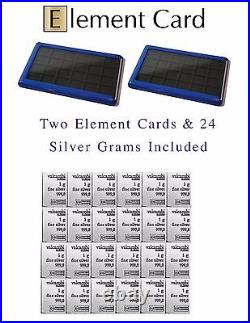

Element Card is here! Element card holds 24 single gram Combibars from Valcambi. 12 slots were designed deeper to accommodate silver and palladium. Gold pictured is not included and is only photographed to show the function. 2 Element Cards Empty Blue color. 24 grams Valcambi Combibar silver. Gold bullion has been traded for a very long time around the world. Gold is used in jewelery, in electronics, in dentistry, and in several other industrial applications. The price of gold is influenced by many different events. Because gold is a commodity, supply and demand as well as speculation can fuel price changes. Gold is a popular investment when economic times are tough, so gold will tend to rise during periods of economic instability and will tend to fall during times of economic stability. Silver bullion is a very popular choice for investors because of its relative low cost compared to bullion of other precious metals. Along with gold, silver has been used for thousands of years as legal tender and as a way to keep wealth. Speaking broadly, the price of silver generally tends to move in a similar direction as the price of gold. However, much less silver is traded than gold, which can make the silver market much more volatile than the market for gold. There are several factors that can influence the price of silver. Some of these factors include the way the asset is traded. For instance, because the volume for silver trading is low, someone who buys or sells a large amount of silver at one time can impact the price significantly. Silver is a widely used industrial metal. In fact, some experts suggest that over 90 percent of all mined silver has been used and can never be recovered. In addition to several medical supplies, silver is used in electronics and jewelry. Silver bullion is a popular investment throughout any economic period, but it is a popular investment especially when there is an economic downturn. Much like with gold bullion, investors flock to physical precious metals when paper assets become devalued or there is a currency crisis. Silver, much like gold, also provides a hedge against future inflation. While gold and silver have been traded in financial markets for centuries, platinum is a newer precious metal. One of the rarest of all the precious metals, platinum tends to trade at a higher price than most of the other precious metals, and platinum bullion products tend to carry higher dealer premiums per unit than other bullion products of other precious metals. Platinum isn’t used in very many industrial applications, so the price of platinum is usually determined by consumer sentiment and supply and demand factors. Typically, when economic markets are doing well, the price of platinum bullion rises. When economic markets are struggling, the price of platinum tends to fall. Many people believe that platinum falls when financial markets are struggling because gold and silver become so popular with investors that the demand for platinum lessens. Palladium is another uncommon precious metal that people have started to invest in more recently. Palladium has more industrial uses than platinum does, including potential uses in automobile parts. Speculation based on this industrial demand drove the price of palladium up to record levels soon after the new millenium. Palladium bullion tends to be less liquid than other forms of precious metal bullion because it is a less popular investment and carries higher dealer premiums. Not only are there several metals that bullion can be composed from, but this bullion can take one of several forms as well. In addition to bars of bullion, bullion also comes in coin form and rounds. Bullion bars are a popular investment. Not only are they easy to stack and store, but they can also hold significant amounts of wealth. They can be kept in either a bank safe deposit box or in a safe at home, but one of the downsides to storing bullion at a bank is that it is often uninsured. Bullion bars, depending on the metal, can be found in a wide variety of sizes. Many of the newer bullion bars that are being created feature special hallmarking. This hallmarking is used to help prevent forgery and is used for certification and verification purposes. Gold bullion bars are a very popular way to invest in gold. Gold bars can come in a variety of sizes and weights, including bars that weigh a few grams up to the 32.15 troy ounce kilobars. One of the unfortunate truths about gold bars is that they are popular to forge. Perhaps surprisingly, it can actually be very difficult to assess whether or not a gold bar is real. The only way to authenticate a gold bar’s content is to melt it down and assay it. Avoiding forgeries is easy, though, when a person finds a dealer and buys bars that have been hallmarked. Silver bullion bars can be found in many weights, ranging from one troy ounce to 1,000 troy ounces. A bullion bar weight of about 100 troy ounces tends to be the most common form of bar available. The larger bars can be quite heavy as 1,000 troy ounces weighs roughly 68 pounds. Platinum bullion bars are most often found in weights of 10 troy ounces. These bars will be minted by some of the world’s leading refiners, and they will be hallmarked so that the weight and purity are certified and can be verified. Much like platinum bullion bars, palladium bullion bars are typically rarer than their gold and silver counterparts. These bars are most typically found in 10-ounce weights, and because they are a more recently traded precious metal, they generally feature hallmarks and additional certification. The value of coined bullion lies in the purity and mass of the bullion and not in the face value of a coin. The bullion purity value of a coin will never equal 100 percent. The metal extraction and minting process causes the need for alloys to be blended into the metal, which causes a loss of purity. However, modern practices have allowed bullion coins to be created with up to 99.9999 percent purity. Gold coins have been prized by collectors and investors for centuries. In fact, the Saint Gaudens Double Eagle is recognized by many to be one of the most beautiful coins of all time. Gold coins will come in a variety of weights, including coins larger than an ounce and coins as small as one-tenth of an ounce. While most people think that 24-karat gold is the standard for gold coins and for value, the American Gold Eagle is actually only minted with 22-karat gold out of historical tradition. The American Gold Buffalo is a good option for people who are looking to invest in 24-karat gold coins, and several other countries around the world mint 24-karat gold coins that feature 99.99 percent purity as well, including Canada, Austria, and China. Silver bullion coins are a favorite for collectors and investors alike. Not only is silver a relatively inexpensive precious metal, but many of the coins that are minted are beautiful as well. Many countries mint silver bullion coins, with the United States American Eagle, the Canadian Maple Leaf, and the Australian Kookaburra being some of the most sought after and heavily traded. The Canadian Maple Leaf is the most pure, commonly minted silver coin available, with a bullion purity of 99.99 percent. The American Eagle, on the other hand, has a purity value of 99.93 percent. Earlier United States coins, such as dimes, quarters, half-dollars, and dollars, featured a significant amount of silver in them. Up until 1964, these coins contained 90 percent silver. Platinum bullion coins come in a few sizes, including one-ounce, one-half-ounce, one-quarter-ounce, and one-tenth-ounce. Not many countries mint platinum coins because of the high cost and difficulty. Much like platinum coins, palladium coins are rarer than gold and silver coins. Two of the most popular palladium coins include the Canadian Maple Leaf and the Chinese Panda. Rounds are shaped like coins, but they cannot be used as legal tender. Certain minting companies can make custom rounds with special designs printed on them. Most rounds come in weights of one ounce. On the top left side of the screen, just underneath the search bar, is a list of shopping categories. Find the Collectibles & Art. Tab and hover the mouse over it. A list of subcategories should pop up. Or Gold & Silver Bullion Center. From this second list of categories. By using the Bullion tab or by searching for specific bullion coins in the Coins: US section or the Coins: World section. On the Gold & Silver Bullion Center page, buyers can search for specific metals or specific forms of the metal. Gold and silver are some of the most popular searches, and shoppers can select other popular searches by using the links at the top of the page that are underneath the search bar. Searching by using the Most Popular links allows people to search for items like one-ounce American Eagles. Buyers can use the search tools on the left side of these pages to narrow down the results that are displayed. Buyers can also use the search bar at the top of the page to search for listings that include specific keywords. Keyword searching can be used with the search tools on the left of the page to display very specific results. Precious metal bullion is not only great to collect, but it’s a lucrative investment as well. Bullion is easy to store in any form, and it can provide additional security against financial turmoil around the world.